Apple touts $1.1 trillion in App Store commerce in 2022, with $104 billion in digital sales

[ad_1]

ahead of Apple world developer conference next week, the company is offering an update to its app ecosystem with the release of a new report detailing the app’s earnings over the course of the past year. In the analysis, released today, Apple says its App Store ecosystem generated $1.1 trillion in developer billing and sales in 2022, 90% of which was commission-free, a metric it likes to tout to minimize growing complaints about the app. High cost of doing business in a marketplace that typically charges a 15-30% commission on in-app purchases and paid downloads, with a few exceptions.

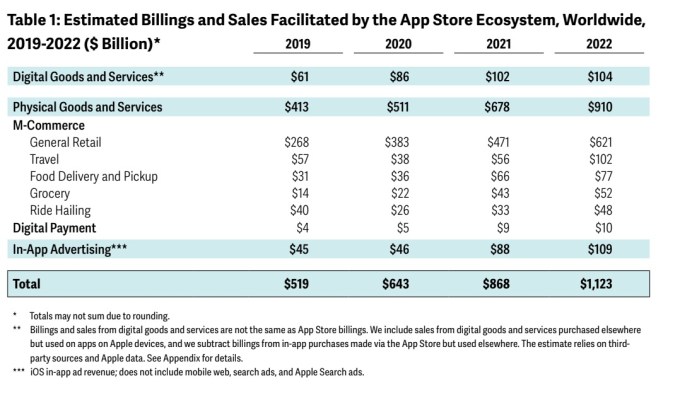

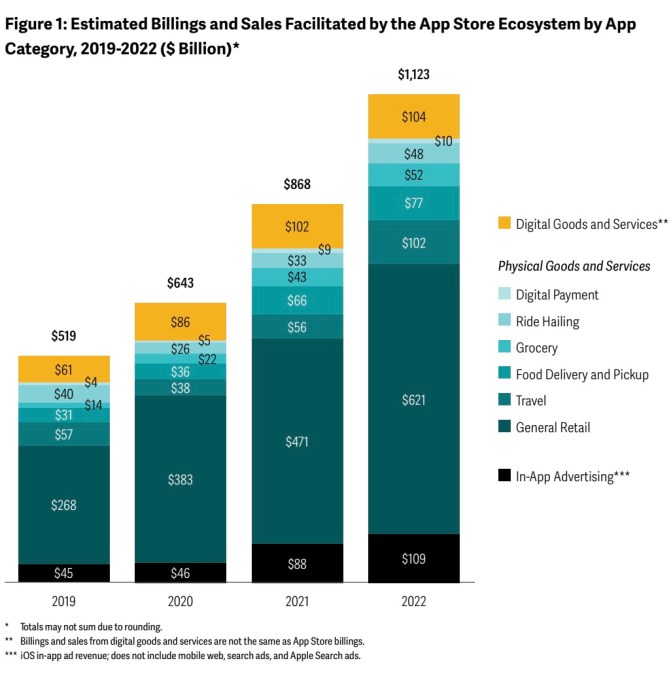

This $1.1 trillion breaks down into $910 billion in total revenue and sales from the sale of physical goods and services, $109 billion in in-app advertising, and $104 billion in digital goods and services. .

The numbers are a sizeable increase from 2019 data, when Apple said the App Store had facilitated $519 billion in trade, with then “only” $61 billion coming from digital goods and services.

Image Credits: Apple

Apple also said that iOS app developers earned more than $320 billion in the App Store from 2008 to 2022, a jump of the $260 billion reported in 2021.

Today’s new study comes from Analysis Group, the same group of analysts Apple began working with beginning in 2020 to Crunch your App Store data — and to shed light on the significant trading taking place in Apple’s app marketplace as regulators began working on new rules to dismantle the tech giant’s grip on the iOS app ecosystem.

While the grand totals by category are the main draw of today’s report, Apple also shared other figures related to the growth of the App Store. This included a slight uptick in developer sales and billing growth between 2021 and 2022, to 29%, when the previous two years saw 27% growth. Profit growth for small developers, in particular, grew 71% between 2020 and 2022, outpacing large app developers, Apple said. (However, that figure is much more of a vanity metric, as smaller developers often earn smaller revenues, which are much easier to double or triple compared to larger developers’ revenues.)

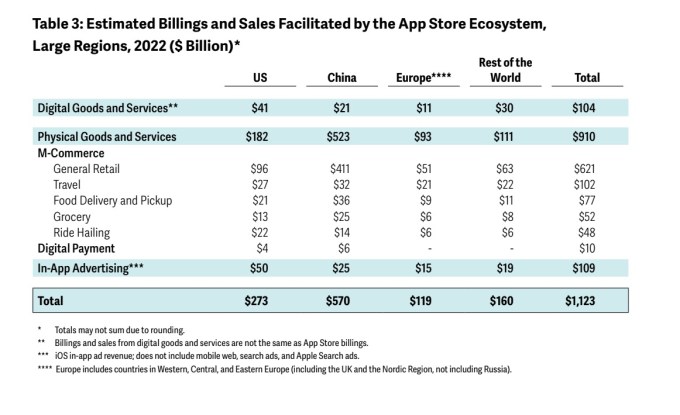

The company further broke down revenue and sales by geography, noting that US developer revenue and sales increased by more than 80% since 2019, while in Europe that figure was 116%. In particular, Europe has been the focus of new regulations that will impose strict new requirements on how the App Store operates. with the EU Digital Market Law (DMA), Set to take effect in 2024, big tech companies will have to allow alternative app stores on their platforms. a recent Bloomberg report suggested Apple I was already building the foundations to enable this functionality, in fact.

Image Credits:

Additionally, the new report offered an analysis of app revenue and sales growth across various categories, including things like food and groceries, travel, ride-sharing, and others. Analysts found that the post-Covid recovery helped rideshare and travel apps bounce back, with the categories seeing an 82% increase and a 45% increase in sales, respectively, in 2022. more than tripled.

Image Credits: Apple

Business apps were also one of the “fastest growing” categories, according to the report, adding that business apps accounted for 5 of the top 25 most-downloaded apps in the US, for example. In addition, entertainment apps experienced the “highest growth” in digital goods and services, thanks to trends like the creator economy. The latter reflects a trend already noted by third-party application intelligence provider data.ai, which cited entertainment and social applications as the top global app subgenres in 2022.

The report also included a look at iOS downloads, confirming that users have downloaded apps more than 370 billion times between 2008 and 2022. The App Store has nearly 1.8 million apps, or 123 times the number it used to. at the end of 2008. (It should be noted that that “almost 1.8 million” figure seems to represent a slight drop, since Apple said a year ago that it had “more than” 1.8 million.)

Apple’s own data, while useful, only offers a window into the broader app economy. Although Apple’s numbers always paint a picture of a vibrant and optimistic app ecosystem, the reality is that some developers have grown frustrated with fee pricing and strict rules, many even sitting down with Justice Department lawyers to complain while the US builds an antitrust case. Many of the apps that now generate considerable revenue are also what might be called “fleeceware,” that is, apps that try to trick consumers into subscribing to high prices in exchange for minimal functionality. A 2021 report even estimated that these apps had generated more than $400 million on the App Store and Google Play, which is a sizeable part of the app economy. The Washington Post also that year reported almost 2% of the top-grossing app store apps were scams.

Meanwhile, the app ecosystem, including Android app stores, saw its first slowdown in 2022with a 2% drop in consumer spending, data.ai reported in its annual “State of Mobile” report.

The full report offers more data on the Apple ecosystem, including more breakdowns by region and category, historical analysis, and additional information on trust and security measures, such as app rejections, which were also recently detailed in a separate report released earlier this month.

[ad_2]

Source link